This report provides insight into the key scenarios for how the global and UK energy system could evolve in the coming decades. These scenarios allow for an informed debate as to the economy-wide changes that will need to take place if the UK’s net zero commitment and the global goals of the Paris Agreement are to be achieved. This insight will help inform OGUK members of what this means in the context of the domestic oil and gas industry and its role in the future.

Key Points

- Globally, oil and gas are expected to provide at least half of total cumulative energy demand over the next 30 years through to 2050 against a range of scenarios, albeit these may not all comply with the aims of the Paris Agreement.

- In all UK Climate Change Committee (CCC) scenarios (all of which are net-zero compatible) oil and gas accounts for between 47% and 54% of total cumulative energy demand between 2020-2050.

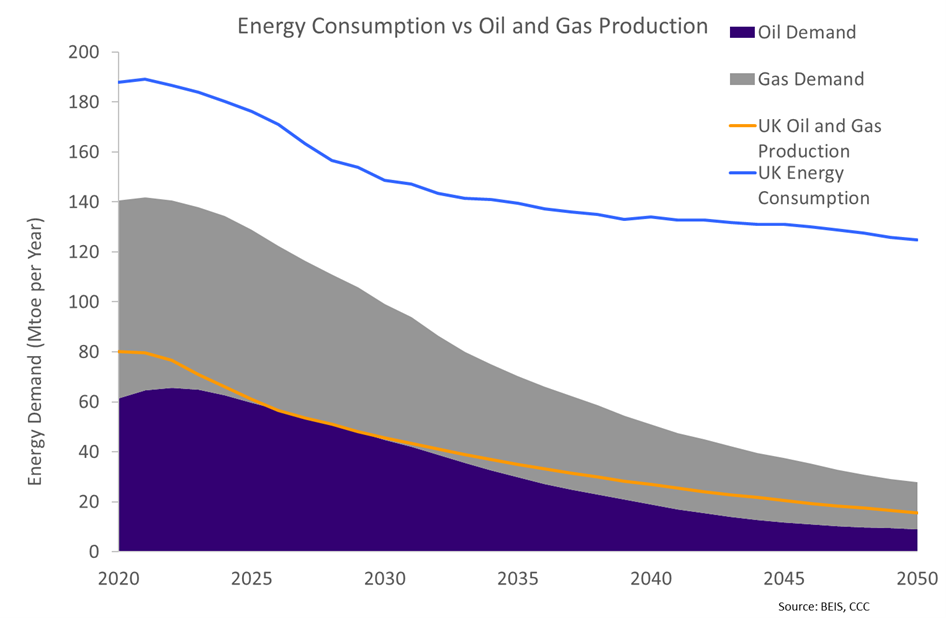

- In 2020 domestic offshore oil and gas production accounted for more than 70% of UK oil and gas demand, and has the potential to continue to meet at least half of demand through to 2050.

- Oil and gas will be important in the energy transition in the UK and around the globe and will also continue to be needed not only for manufacturing feedstock as well as energy use.

The Global Context

In 2020 global energy demand fell 4%[1] compared with 2019 due to the pandemic disrupting global energy markets and reducing travel and industrial activity. In the latter parts of 2020 and into 2021 demand has been recovering, and compared with long term forecasts global energy demand is on track to increase by 4.6% in 2021 (0.5% above 2019 demand levels).

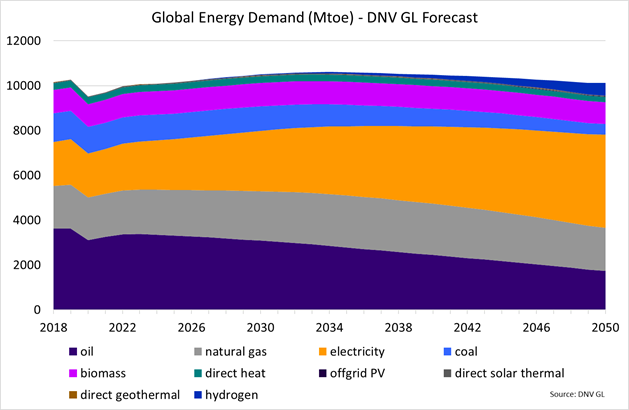

Over the next ten to 15 years, DNV GL forecasts that global energy demand will continue to increase, reaching a peak in 2034 [2]. DNV GL anticipates a peak in natural gas demand in 2037, highlighting that our industry will still play an important role in the years to come. However, its forecast also suggests oil demand is likely to have already peaked. Despite having reached its peak, oil continues to be an important part of the mix, supplying 29% of cumulative demand through to 2050 in this scenario, and gas providing 21%. It is important to note that DNV GL’s forecast is not compatible with the Paris Agreement’s target of keeping global warming below 2°C by 2050, as it does not see behavioural, societal and cost profiles of greener technology changing at a quick enough rate to meet the Agreement.

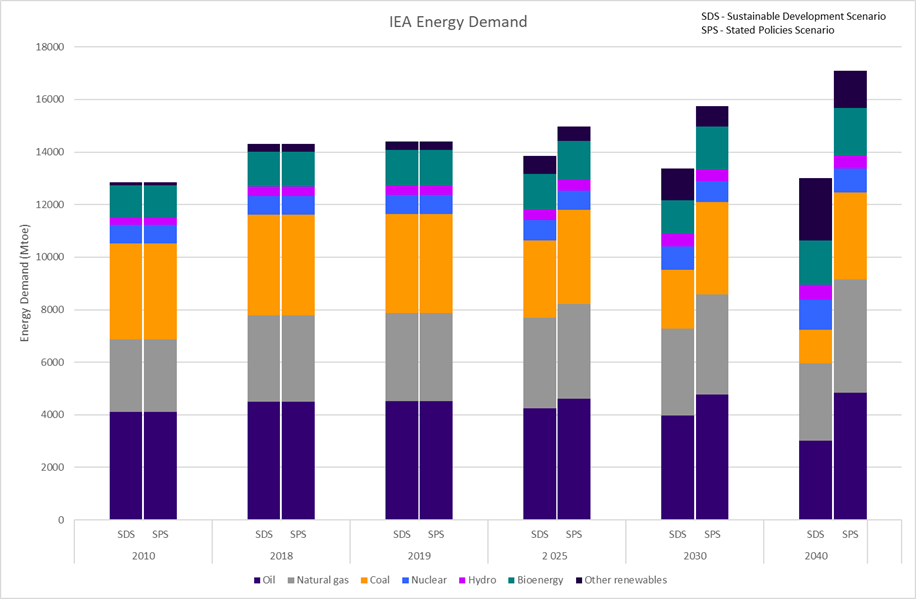

In the International Energy Agency’s (IEA) 2020 World Energy Outlook [3] there are two key scenarios of how energy demand may evolve. The Stated Policies Scenario (SPS) reflects existing and announced policy intentions (which are not compliant with the aims of the Paris Agreement), whereas the Sustainable Development Scenario (SDS) outlines how the energy system can be transformed to help meet the UN Sustainability Goals and achieve the Paris Agreement aims.

In the SPS, global energy demand returns to pre-pandemic levels by the end of 2021. Total primary energy demand could go on to increase by 19% by 2040 (from 2019 levels), however in the SDS demand falls by 10% during the same period. In the latter scenario there is a larger shift into clean energy policies and investment to support the energy system in achieving sustainable energy objectives, including the Paris Agreement. In the SPS, oil accounts for 28% of primary energy demand and natural gas 25% in 2040; in SDS both meet 23% each of primary demand by the same date.

It is important to note that these figures are only related to energy use. Non-energy use – primarily for petrochemicals – currently accounts for 13% of overall oil demand. The IEA scenarios model growth in petrochemical feedstock of between 34% and 43% by 2040 from 2019. In the SDS it forms an increasing proportion of oil demand, accounting for 26% of total demand in 2040, or 790 million tonnes of oil equivalent (Mtoe). Although there is greater absolute petrochemical demand in SPS, it accounts for 18% of total oil demand (848 Mtoe). This is because in this scenario total oil demand is expected to grow by 7% towards 2040 from 2019 levels compared with a contraction of 34% in the sustainable development scenario.

May 2021 saw the IEA has release its ‘Roadmap for the Global Energy Sector – Net Zero by 2050.’ [4] Within this, it is modelled that total global final energy consumption would have to fall by 17% between 2020 and 2050 to reach net zero. As part of this, they outline a large drop in both oil and gas consumption, falling by 73% and 70% respectively throughout the period. This new report is different in its scope and content to the World Energy Outlook (referred to above) and OGUK will therefore release a separate Market Insight to members, providing a deep dive into the IEA Net Zero Roadmap.

What about the UK?

For the UK, like the global context, there are many different scenarios to consider, with the CCC having considered over 70 scenarios in its 6th Carbon Budget.[5] The main four examined in its report are Headwinds, Widespread Engagement, Widespread Innovation and Tailwinds, which are then combined into a Balanced Net Zero Pathway. These four scenarios are all consistent with meeting the UK’s climate ambitions, however have various outlooks for the deployment of new technologies in end-use sectors, with the Balanced scenario taking a mix of the four. The differences between the scenarios are largely due to costs of greener technologies reducing at different rates, along with earlier adoption of those technologies and hybrid systems (please refer to the appendix below for specifics of the scenarios).

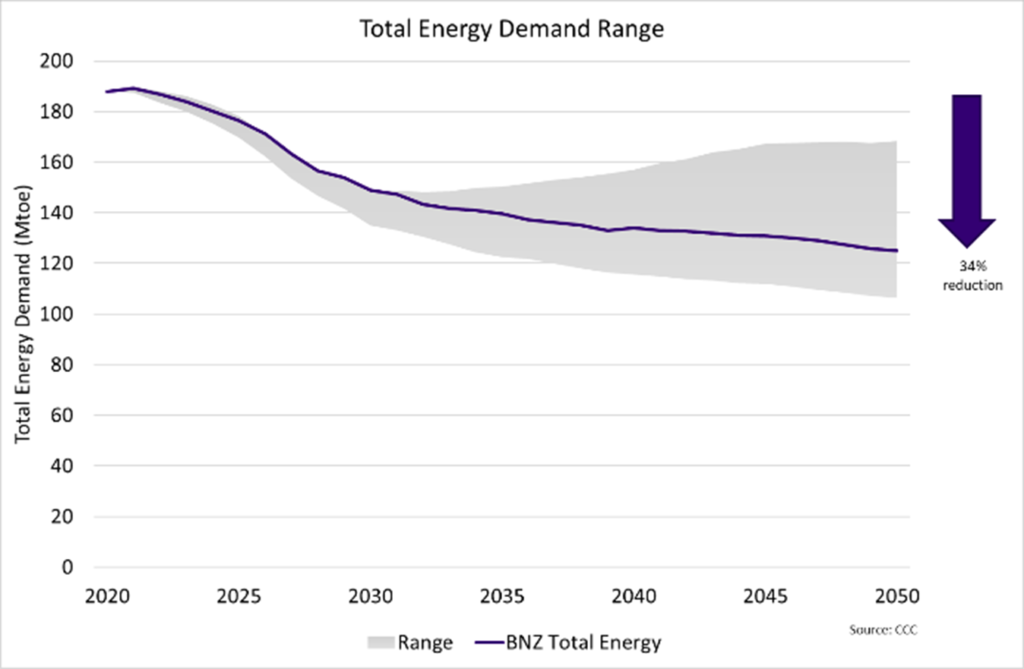

In the Balanced net zero scenario, total energy demand in the UK is forecast to fall 34% by 2050 when compared with 2020 levels. Even in the least ambitious scenario total energy demand is still set to fall 11%. All demand scenarios see the largest changes in the next ten years, however there is then a divergence in the early 2030s in the Headwinds scenario which models demand returning to growth. This is in large part due to little movement in electricity use as cost profiles for green technologies do not decrease as quickly. This scenario sees greater use of blue hydrogen, later movement to electric passenger vehicles and higher aviation demand resulting in energy efficiency losses compared with other scenarios. In all other scenarios, demand continues to fall towards 2050, with improving efficiency as a result of using more green technologies or a mix, as forecasted in the Balanced net zero pathway.

UK Oil Outlook

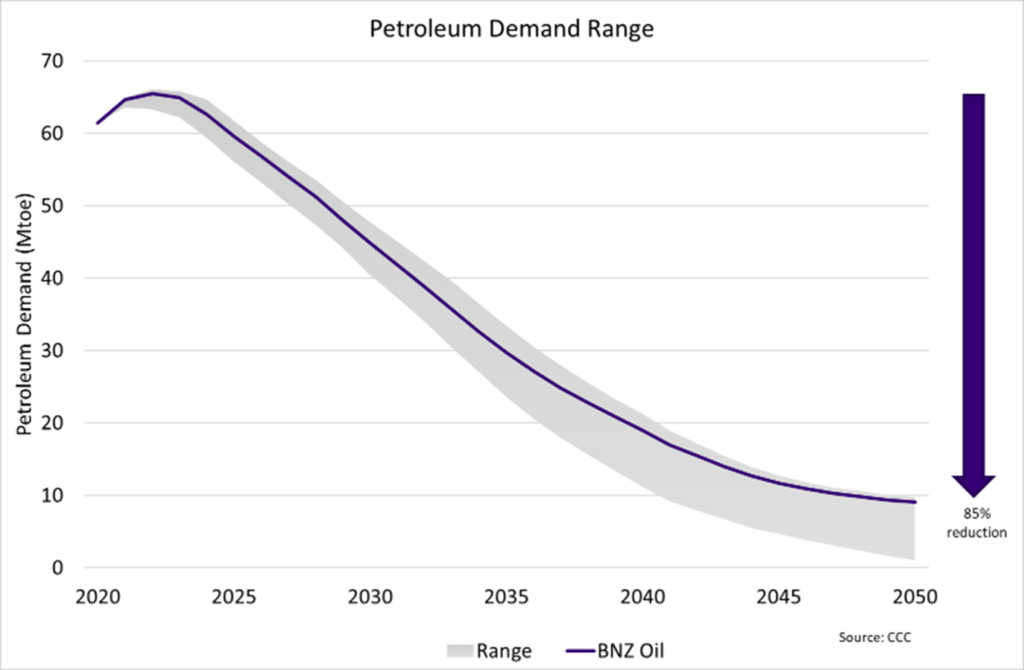

What is common across all scenarios is the significant fall in petroleum demand, coming together to form an 85% decline in the Balanced scenario. However, this still represents around 9Mtoe of annual demand in 2050 (the equivalent of around 170,000 barrels per day. In 2050 petroleum demand is forecast to be 5-7% of total energy demand, largely used in aviation – apart from in the Tailwinds scenario where there is a 95% use of low-carbon fuels in aviation resulting in petroleum meeting just 1% of total energy demand.

UK Gas Outlook

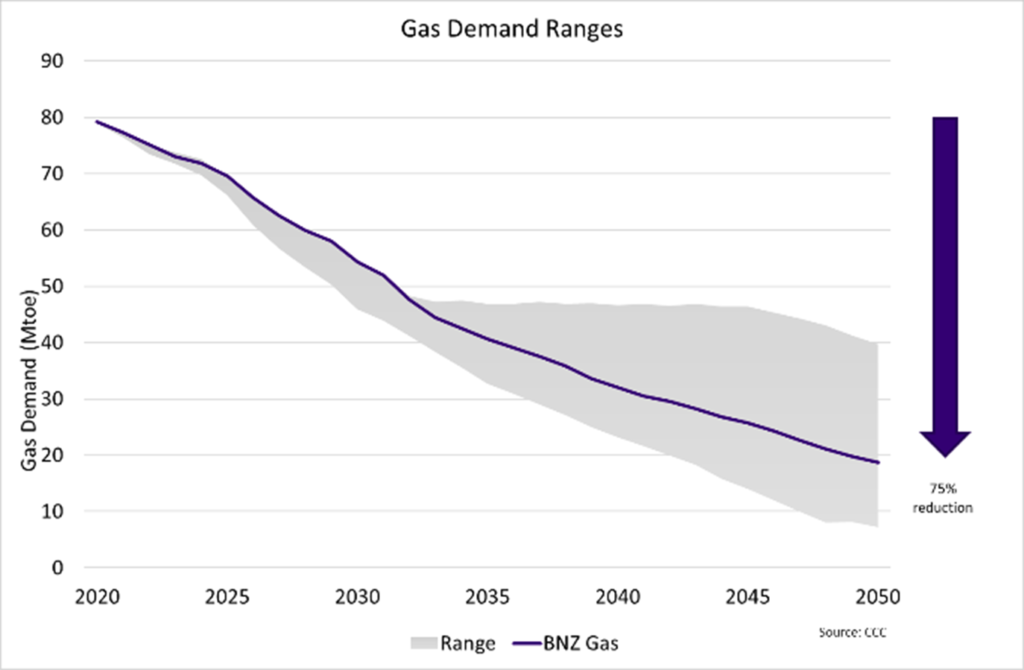

Gas demand sees a slower decline rate but could reduce by 75% by 2050 (to 18.7 Mtoe per year, or around 350,000 boe per day) in the Balanced scenario, and still accounting for 15% of energy demand. In three of the main scenarios gas accounts for between 6% and 11% of demand except for Headwinds where it accounts for 24% of total demand. This is due to Headwinds seeing less electrification in homes, manufacturing and construction (71% of homes would use largely blue hydrogen for heat in this scenario) along with all new vehicle sales being electric by 2035, rather than earlier (2032 in the Balanced Pathway and 2030 in Tailwinds). There would also be widespread hydrogen use in heavy goods vehicle transport.

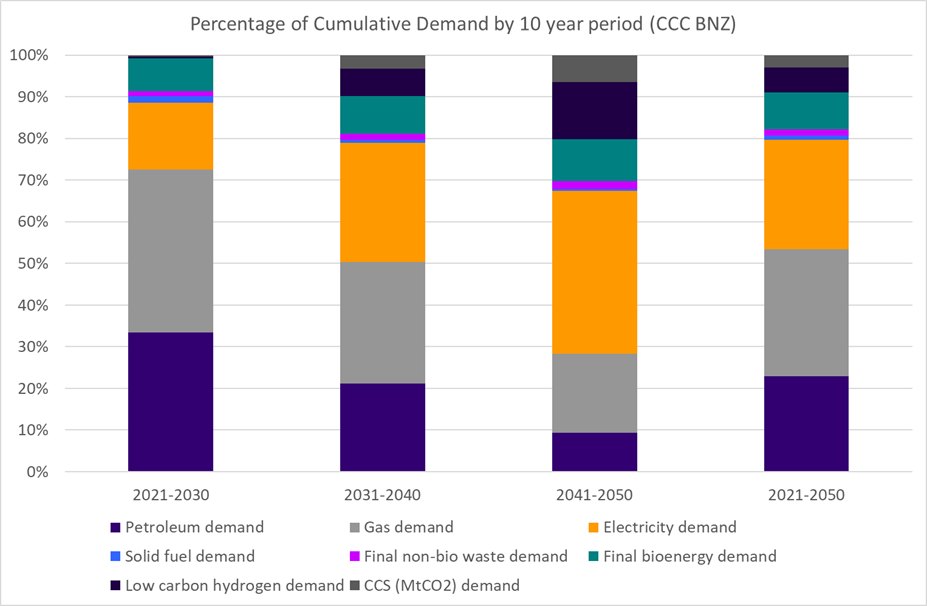

In these scenarios, cumulatively over the next 30 years, oil and gas would contribute between 47% and 54% of total energy demand in the UK – reinforcing the important role of oil and gas in the energy transition. Over the next ten years, oil and gas are modelled to account for 72% of cumulative energy demand in the Balanced scenario and remain the largest element of cumulative energy demand in the 2030s as well. It is important to remember this in the context of the energy transition.

Demand for oil and gas products will remain an important part of energy systems even with major societal and behavioural changes and green technologies becoming significantly cheaper. Our skills as an industry will also be hugely transferrable, not only within the UK’s transition, but other countries around the world.

In 2019 domestic oil and gas production met 59% of UK oil and gas demand. In 2020 this rose to 71% as the effects of COVID-19 led to demand falling at a quicker rate than production. Looking forward, this proportion is likely to decline somewhat, however domestic production can continue to meet around half of demand levels, based on the Oil and Gas Authority (OGA) long-term production outlook[6] and CCC Balanced Pathway demand profile.

A continued focus on Maximising Economic Recovery (MER) and the reduction in production emissions can therefore be compatible with achieving net zero. This is important to ensure security of supply as well as not offshoring emissions to other countries that may not be as far into their energy transition journey as the UK.

Summary

It is important to note that although we have looked at some of the central scenarios and forecasts throughout this insight, there are many more with various technology mixes, behavioural and societal patterns, demand profiles and many other elements that could also be considered. What is clear and consistent throughout these scenarios is that oil and gas will be important in the energy transition in the UK, around the globe and will be needed not only for energy use but for manufacturing and other industrial processes. This industry will continue to meet energy needs – especially in sectors which have fewer and more challenging alternative options for switching to lower-carbon fuels – and provide the transferable skills to other sectors through our people and supply chain, to support the transition. To achieve this, it is important that we have a strong domestic production industry as a foundation – to help provide our energy needs and allow companies and people to pivot towards new diverse opportunities over time.

We should also recognise that many of the scenarios do not achieve the level of decarbonisation needed globally to meet the requirements of the Paris Agreement and the risk of divergence between aims and outcomes to deliver these goals will lead to continued tension on supplies and the imperative to decarbonise energy use in years to come.

Download a copy of this report here.

Footnotes

[1] https://www.iea.org/reports/global-energy-review-2021

[3] https://www.iea.org/reports/world-energy-outlook-2020

[4] https://www.iea.org/reports/net-zero-by-2050

[5] https://www.theccc.org.uk/publication/sixth-carbon-budget/

Share this article