The UK oil and gas licensing round announced today (Friday, October 6) by the North Sea Transition Authority, will boost British gas supplies, sustain the UK’s energy industry and strengthen plans for a low-carbon future, said Offshore Energies UK (OEUK).

The NSTA, the offshore industry’s regulator, has offered 898 ‘blocks’ of the UK’s seabed for exploration. It means energy companies can bid for exclusive licences to explore, and potentially recover, any oil or gas they find. Some will be fast-tracked, with licences allowing new oil and gas finds to be developed rapidly.

The announcement coincides with the National Grid’s Winter Outlook, which warns that the UK’s growing reliance on imported gas has left it exposed to global shortages that could cause rolling blackouts over the coming winter months. Gas produced in UK waters, by contrast, is under the UK’s control and so is a bulwark against such threats.

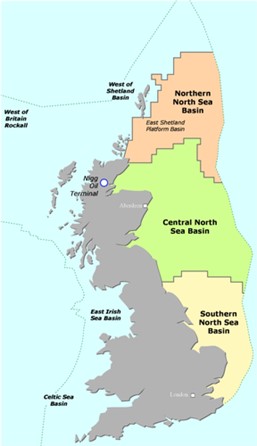

Four key areas in the southern North Sea, Norfolk, Lincolnshire and Yorkshire have been identified as priorities for licensing. This is because the southern North Sea is richer in gas and has known reserves near existing infrastructure. It means they can be brought into production quickly to boost the UK’s energy security.

The areas being offered for licensing also include:

- Central North Sea – an area of the UK’s north-east coast, roughly parallel with Middlesbrough and Newcastle, to the north of Aberdeen and Inverness

- Northern North Sea – north of the Scottish mainland and east of Shetland and Orkney

- West of Shetland – in the eastern Atlantic between the Shetland and Faroe Islands

- East Irish Sea – meaning Liverpool Bay, between the coasts of Cumbria, Lancashire, north Wales and the Isle of Man.

The UK’s offshore industry produced 38% of the nation’s gas and the equivalent of 75% of its oil in 2021. This year the industry has boosted gas production to support the nation through shortages caused by the Ukraine conflict, but new licences are vital if it is to continue this contribution. This is because many of the gas and oil fields around the UK are ageing – so production is declining. Exploration licenses give the industry a way to replace at least part of that lost production with new fields.

The environmental ‘bonus’ is that the greenhouse gas emissions generated in producing oil and gas from newer fields will be far smaller than in older ones. This is because new installations will be designed to minimise the leakage of gas and avoid routine flaring or venting. The UK’s North Sea gas already has less than half the carbon footprint of imported Liquefied Natural Gas.

Any new oil and gas production resulting from new licences would be aligned with the UK’s climate objective of reaching Net Zero (carbon neutrality) by 2050. The Climate Change Committee’s ‘Balanced Pathway’ estimates that the UK will consume gas and oil equivalent to eight billion barrels of oil by 2030.

OEUK’s research suggests the North Sea could produce only about half this amount even if all planned developments went ahead. The rest would be imported.

It means that, if new resources were discovered, especially gas, they could reduce UK imports but would make little difference to the UK’s energy consumption or its production of greenhouse gases. Such emissions are driven largely by the UK’s infrastructure such as the 24 million homes heated by gas boilers, the 32 million cars running on petrol and diesel, or the 30-plus power gas-fired power stations that produce two-fifths of our electricity.

Access the interactive map of the UK’s offshore oil and gas installations and pipelines.

Licensing rounds are usually annual events but the last (32nd) licensing round was launched in July 2019 and released in Sept 2020 with 113 licences awarded to 65 companies. The process has been on hold since then, pending consultations on the environmental impacts of further oil and gas exploration.

That delay, plus other factors such as the pandemic, mean that just five exploration wells were drilled in 2021 – the lowest number ever – according to OEUK’s Economic Report 2022, published last month.

Companies will now have till January 12 to submit their bids, with the NSTA expected to announce the results in late spring of 2023. Each stage that follows – exploration, development and production – would be subject to further consent from the NSTA and the Offshore Petroleum Regulator for Environment and Decommissioning (OPRED).

Mike Tholen, OEUK’s acting chief executive, said: “The UK gets 75% of its total energy from gas and oil so producing our own minimises our vulnerability to global shortages of the kind caused by the Ukraine conflict.

“There is no conflict between issuing new licences and reaching carbon neutrality. Our industry is committed to net zero and also to helping build the low-carbon energy systems of the future. But this is a journey that will take decades during which we will still need gas and oil.

“Many existing UK oil and gas fields are in decline so the risk is that production will drop much faster than demand, leaving us more dependent on imports. That is why new licences are so important.

“New licences also help maintain continuity for the energy operators and for our vital supply chain companies which, between them, employ over 200,000 people. “The success of this and the next licensing rounds will be vital for our nation’s long-term energy security and to ensure we deliver on the UK’s commitment to reach net zero by 2050.”

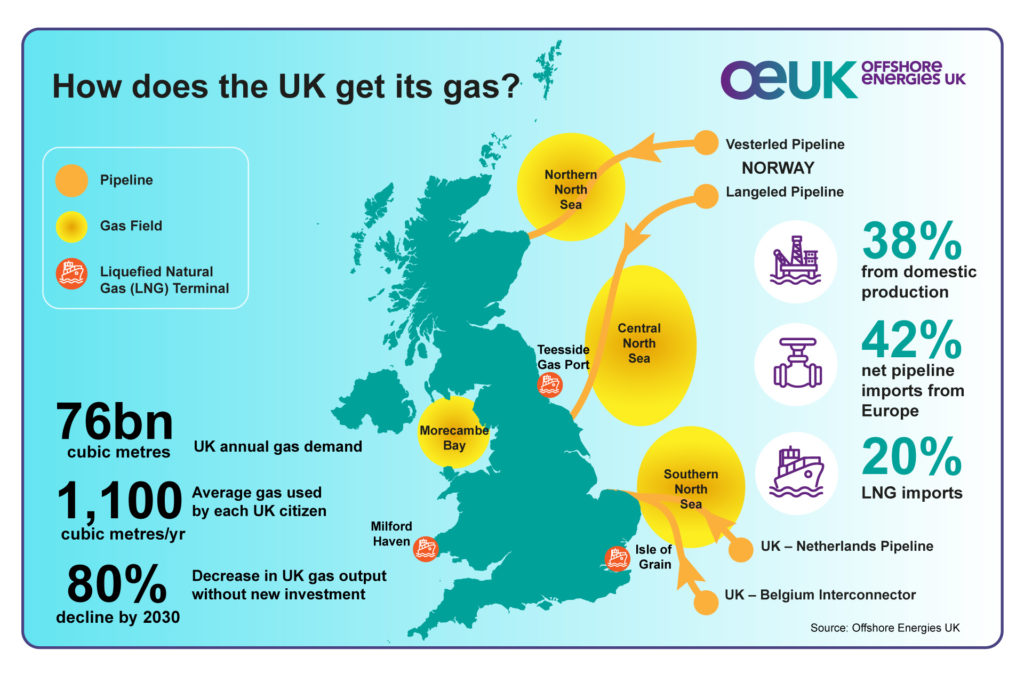

How does the UK currently gets its gas

Background briefing

The North Sea, Irish Sea, and waters around Scotland, still contain oil and gas equivalent to 15 billion barrels of oil, according to estimates in the UK Oil and Gas Reserves and Resources Report, just published by the North Sea Transition Authority (NSTA).

However, those resources can only be accessed if new licences are issued. Licensing is part of a continuous process that sees some oil and gas fields being opened or expanded every year – while older ones close

This ‘churn’ is due to the geology of the UK Continental Shelf (UKCS). It has hundreds of oil and gas reservoirs, but most are small relative to those in major oil and gas-producing countries like Russia and Saudi Arabia. This means there are always some fields approaching depletion and decommissioning.

It also means UK operators need to open new fields, or expand existing ones with new wells, simply to maintain output and keep meeting demand. Production had been falling at about 5% a year on average but last year it dropped by 17% – a sign of the rapid decline that would follow any failure to issue new licences.

It follows the government’s British Energy Security Strategy, published earlier this year, which promised just such a new licensing round. Prime minister Liz Truss said recently that she hopes more than 100 licences will be awarded.

Fast Facts

Editor Comment: Check figures before reuse. eg UK government Digest of UK Energy Statistics

- Gas and oil supplied 75% of the UK’s total energy in 2021.

- Gas is our largest energy source, supplying about 41% of total UK energy

- Oil is the second largest source, providing about 34% of the UK’s total energy

- The UK’s production of oil and gas fell sharply in 2021.

- Oil Production was 45m tonnes

- Gas production was 29bn cubic metres of gas

- These figures represented a 17% decline on 2020 and a 20% decline on 2019

- Without new oil and gas imports will surge. By 2030, the UK would have to import

- 80% of its gas

- 70% of its oil

- Gas production increased by 27% in the first half of 2022 – buoyed by new projects off England’s east coast and efficiency drives. This increase will, however, be short-lived without new licences

Gas Demand – how much gas does the UK consume?

- 78 billion cubic metres – Amount of gas consumed by the UK in 2021

- 1,100 cubic metres – Annual UK gas consumption per person in 2021

- 43% – Proportion of UK energy supplied by gas – making it the UK’s largest source of energy

- 24 million homes – About 80% of UK homes rely on gas heating

- 42% – Proportion of UK electricity produced by burning gas

Oil Demand – how much oil does the UK consume?

- 55 million tonnes – of oil and oil products consumed in 2021.

- 0.8 tonnes – Annual oil consumption per person in 2021

- 32% – Proportion of UK energy supplied by oil, our second largest source of energy

- 32 million – number of cars and other vehicles relying on petrol or diesel fuels

- 22 million tonnes – consumed as diesel

- 10m tonnes – consumed as petrol

- 1.5 million – Number of UK homes relying on heating oil (equating to 6m people)

Share this article