The UK government’s new windfall tax, imposed on companies supplying the nation’s oil and gas, may already be undermining the major investments need to keep Britain’s lights on, Offshore Energies UK has warned.

It follows reports in The Sunday Telegraph that Equinor, the Norwegian state energy company, is considering abandoning its £4.5 billion investment in the Rosebank Field, near the Shetland Islands.

The paper also reports that Shell has separately told analysts it is also less likely to develop the £2bn Cambo project in the North Sea after the UK’s Government’s profit raid. The new windfall tax imposed an additional 25% tax on the profits made by offshore energy firms operating on the UK continental shelf.

OEUK said it was for such companies to comment on their individual plans, but it was becoming clear that the new tax would put investment at risk.

The UK’s oil and gas operators – which includes many smaller independent companies as well as the better-known global giant, were already paying 40% tax on profits – the highest rate of any sector.

The new levy means they are paying 65% – a rate which makes investing in new gas and oil fields in UK waters far less attractive.

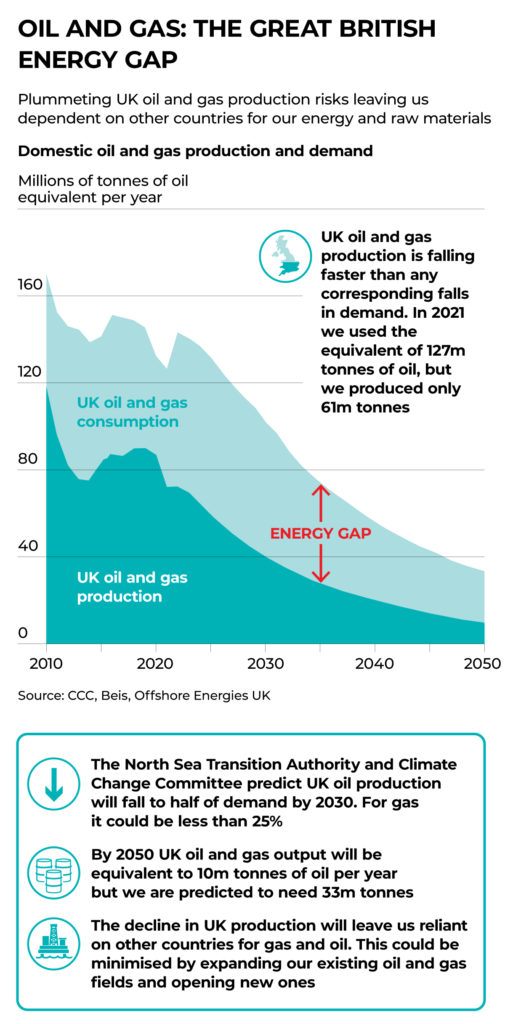

Without such investment production is predicted to decline rapidly – leaving the UK increasingly dependent on imports from other countries.

OEUK research suggests that, without new investment, by 2030 around 80% of UK gas supplies and more than 70% of oil supplies will have to be sourced abroad.

Deirdre Michie, chief executive of OEUK, said it was for Equinor and Shell to comment on their own particular plans, but added: “This is an industry that thinks and plans long-term, so sudden new taxes will always disrupt investment plans.

“The windfall tax may not affect projects already under way – but is likely to deter investments under consideration, for which funds have yet to be committed. The UK’s offshore sector includes many independent companies who spend years planning investments that can be very risky.

That is why the industry always considers a stable and predictable fiscal regime to be key to its investment criteria.

“Our industry is very proud to pay its taxes and support the UK government and consumers, especially in difficult times like these. The problem is that if new taxes are imposed there is always a negative impact on investor confidence.

“In particular, such moves increase the cost of borrowing for new projects, making it more difficult to raise the money needed to maintain existing energy supplies and build the low carbon energy systems of the future. “The result will be a decline in oil and gas production in years ahead – just when the UK most needs reliable sources of energy.”

Share this article